Grafton Capital has invested £7 million into Third Financial Software, the fast growing, innovative investment platform and software provider. Grafton Capital’s investment takes it to majority ownership of the business, with £1.5m of fresh capital being injected onto the balance sheet.

The deal follows previous investment rounds in 2015 (£2.5m) and 2016 (£1.5m) to support the expansion of Third Platform, the fintech infrastructure platform, which serves leading wealth managers, IFA networks, family offices and fintech firms. In this next phase, Third Financial Software is focused on accelerating the growth of the platform, with a particular emphasis on the emerging fintech investment platform market.

Third Financial Software initially provided a CRM workflow software solution for wealth managers, called Tercero, and achieved rapid success. In 2016, it launched a subsidiary business called “Third Platform Services” – a fintech platform that has seen rapid traction amongst wealth managers, IFA networks, fintech startups and family offices. The investment platform gives clients a comprehensive overview of the market, trading activity and back office operations. The technology also enables clients to launch their own white-labelled Direct to Consumer (D2C) investment platform across all asset types.

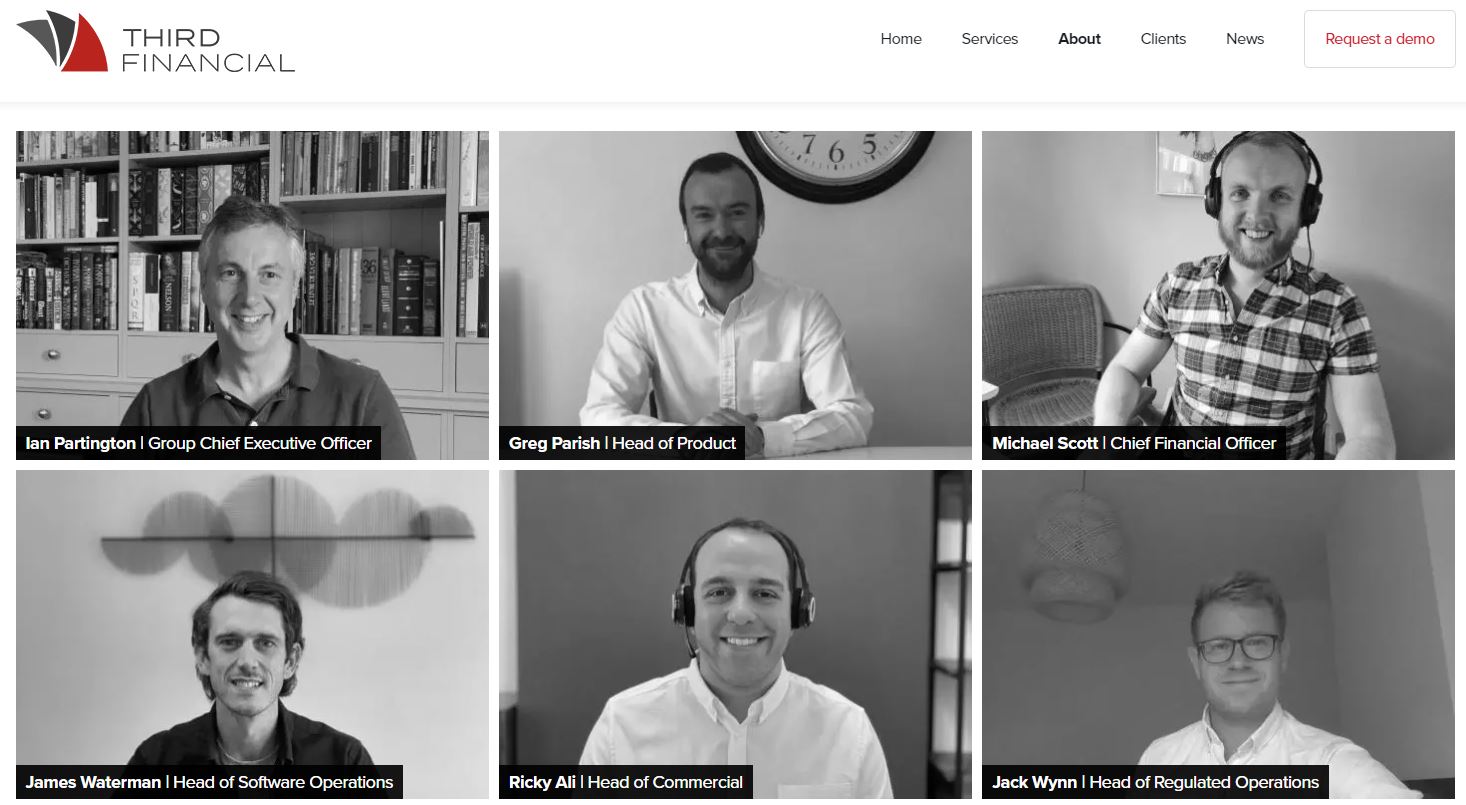

Edward Barroll Brown, Founder and Managing Partner, who led this investment for Grafton Capital said: “We have a long standing history with Third Financial Software which dates back to 2015. Since its launch, the fintech platform has been achieving steady annual growth of 40 to 50 per cent, and more recently has done so whilst maintaining profitability. This investment is about backing Ian and his team to continue on this path of profitable growth, and we are confident in the trajectory and the opportunity to serve more great businesses with Third Financial’s market leading infrastructure platform.

“Grafton Capital invests growth capital in leading technology businesses across Europe and looks to back exceptional founders and management teams, which is certainly what we have here at Third Financial. We typically make minority growth investments, but are delighted to close this growth buyout, which we are able to do when the circumstances are right.”